Areas: The most popular locations for Spanish property are the Costa Blanca, Costa Del Sol, the Balearics (Ibiza, Mallorca and Menorca) and the Canaries (Gran Canaria, Tenerife and Lanzarote), followed at some distance by the other costas (Costa Brava, Costa Dorada, Costa Almería, Costa Cálida and the Costa de la Luz). The major cities, particularly Barcelona and Madrid, are also popular with foreigners, who are also to be found in many inland villages along the costas. There is, however, much more to Spain than the Mediterranean coastal resorts and the islands, and less popular regions such as the northern Cantabrian coast and inland cities such as Seville and Granada also have their enthusiasts. The Costa del Sol is Europe’s sunniest region during the winter, although if you want really hot weather and wish to swim in the sea during winter without freezing, the only choice is the Canaries.

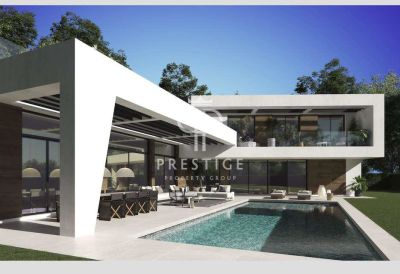

Cost: Spanish property prices vary considerably with the region and town, and with the size and quality of a property. On the Costa del Sol, resale studios and one-bedroom apartments start at around €100,000, two-bedroom apartments at around €150,000 and three-bedroom apartments at €180,000. Two-bedroom townhouses cost from around €180,000 and three-bedroom townhouses from €250,000. Small two-bedroom detached villas can be purchased from around €250,000 and three-bedroom villas from around €300,000. For those with deep pockets the sky’s the limit and there’s a huge choice of luxury villas and estates costing from around €550,000 upwards. Spanish property prices are generally lower on the eastern Costa del Sol than at the western end (i.e. west of Malaga). Prices on the Costa del Sol are generally around 10 to 20 per cent higher than on the Costa Blanca and property in the Balearics and the Canaries is usually around 20 per cent more expensive than on the costas. There’s little difference between the price of new and resale Spanish properties, although new properties may be slightly cheaper. Second-hand or resale properties are often good value in Spain, particularly in resort areas, where the majority of low to medium-priced apartments and townhouses are sold fully furnished. You usually pay a premium for a beachside property or a property with a sea view. Spanish property is less expensive in rural areas, where a farmhouse (finca) with outbuildings and a fair amount of land can cost the same as a studio apartment in a fashionable resort. When buying a community property always check you can afford the community fees.

Local Mortgages: Mortgages are freely available from Spanish banks for both principal and second homes. In Andalucia it is typical to raise up to 75 per cent of the purchase price for non-residents. Spanish mortgages are usually payable over 10 to 15 years, although loans can be repaid over 5 to 25 years. You should shop around, as you may be able to obtain better terms from a foreign or offshore bank for your Spanish property.

Property Taxes: Property tax (impuesto sobre bienes inmuebles/IBI) in Spain is based on the fiscal value (valor catastral) of a property, which is assessed by the local authority and may be different from a property’s actual or market value. It’s important to check the fiscal value of a property, as a number of taxes are linked to it, including income, wealth and inheritance tax. In general, Spanish property tax rates are 0.5 per cent of the fiscal value for urban (urbana) properties and 0.3 per cent for those on agricultural land (rústicas), although in some municipalities they’re as high as 1.7 per cent. However, there’s another value ascribed to property, which is assessed by the tax authorities and published in a set of tables. This ‘tax value’ is often higher than a property’s fiscal value, as the tax authorities revise their tables more frequently than local authorities. In addition to Spanish property tax, you must pay an imputed ‘letting’ tax (rendimientos del capital inmobiliario) at 0.5 per cent of a property’s fiscal value, ‘tax value’ or purchase price, whichever is the highest. Many municipalities also charge an annual fee for refuse collection.

Purchase Procedure: When buying an unfinished property off plan, take care when signing a reservation or option contract that it isn’t a binding purchase contract. A reservation deposit, e.g. €3,000, usually secures a property for up to 30 days. If you pay a reservation fee, this is usually lost if you back out of the purchase, although some developers return it. If a property is still to be built or completed, payment is made in stages. When buying an unfinished Spanish property it’s important to ensure that the developer is financially secure and that any money paid are protected. When you sign the contract (contrato privado de compraventa) for a new or resale property (or a plot), you must pay a deposit. If you’re buying Spanish property privately, you must usually pay a deposit of 10 per cent when signing the initial contract, although the actual deposit is negotiable, particularly on expensive properties. Once you’ve paid the deposit there’s a legally binding agreement between you and the vendor. If there’s any doubt about whether you can complete a sale in the time specified in the contract, you should sign a contract with an option to purchase (contrato de opción de compra). In this case the deposit is paid in the form of an arras or señal and the contract can be cancelled by either party: if the buyer cancels, he forfeits his deposit; if the vendor cancels, he must pay the buyer double the deposit. A deposit should always be held in a separate bonded (escrow) account. Always ensure that you know precisely the terms under which a deposit will be repaid or forfeited before paying it! The final act of the sale is the signing of the deed of sale (escritura de compraventa) and the payment of the balance due, usually paid by banker’s draft unless otherwise arranged. Non-resident purchasers of Spanish property must obtain a certificate from a Spanish bank stating that the amount to be paid has been exchanged or converted from a foreign currency, a copy of which is attached to the title deed. It’s normal for both parties to be present when the deed of sale is read, signed by both buyer and vendor, and witnessed by the notario. In practice, a copy of the escritura will usually be available for scrutiny before the official signing and, if you don’t understand it, you should obtain an official translation. You can give a representative in Spain general power of attorney (poder general) so that he can sign a contract on your behalf. Since 1993, a notary has been required to check the Spanish property register (not more than 48 hours before making the title deed) for any debts against a property or other restrictions which would ‘inhibit’ a sale. When the contract is signed, the notary will give you a certified copy (primera copia) of the deeds. A notarised copy is lodged at the Spanish property registry office (registro de la propiedad) and the new owner’s name is entered on the registry deed. You should ensure that the escritura is registered immediately after signing it, if necessary by registering it yourself. Registering your ownership is the most important act of buying property in Spain, as until it’s registered – even after you’ve signed the contract before a notary – charges can be levied against it. Only when the escritura is registered in your name do you become the legal owner of a Spanish property. Following registration, the original deeds are returned to you, usually after a few months.

Offshore Companies: It’s possible to buy a Spanish property through an offshore company, but the advantages have been largely negated by a law requiring the name of the owner to be declared to the Spanish tax authorities; otherwise a punitive annual tax (impuesto especial) equal to 5 per cent of the property’s value is imposed. When selling a Spanish property owned by an offshore company, you can save fees such as transfer tax, notary and land registry fees, but it’s no longer possible to avoid capital gains and inheritance tax. You should therefore buy a property through an offshore company in certain special cases only, e.g. when there’s a complicated family or inheritance situation.

Fees: The fees payable when buying a Spanish property amount to around 10 per cent of the purchase price and may include the notary’s fees, VAT (IVA), transfer tax, legal fees and a property registration fee. A land tax (plus valía) is also payable when a property is sold and should be paid by the vendor (but you should confirm this). Most fees are based on the ‘declared’ value of a property, which must be no less than the ‘tax value’ assessed by the tax authorities (see Property Taxes above). Property buyers purchasing resale Spanish property must pay a transfer tax (impuesto de transmisiones patrimoniales/ITP) of 6 per cent (4.5 per cent in the Canaries). Buying off-plan or new properties in Andalucia is subject to a transfer tax of 1% but this may vary with other regions. VAT at 7 per cent is also payable on new properties. Legal fees are usually around 1 to 2 per cent of the purchase price for an average property. The notary who officiates at a sale is paid a fixed fee based on a sliding scale depending on the amount of land, the size of the building(s) and the price. The fee for an average Spanish property is around €600. The registration fee is usually between €240 and €300, according to the declared value.

Precautions: Buying Spanish property is sometimes the subject of adverse publicity. It should be noted that most purchasers who have had problems didn’t suffer so much from fraud, but from the insolvency of developers. Developers are now required to have financial guarantees and the legal situation has been tightened to prevent fraud, although the possibility must never be ignored. Nevertheless, it cannot be emphasised too strongly that anyone planning to buy (or sell) property in Spain must take expert, independent legal advice. Never sign anything or pay any money until you’ve sought legal advice in a language in which you’re fluent from an experienced, Spanish-registered lawyer. Checks must be carried out both before signing a ‘preliminary’ contract and before signing the deed of sale (escritura). Note that, if you get into a dispute over a property deal, it can take many years for it to be resolved in the Spanish courts, and even then there’s no guarantee that you will receive satisfaction. One of the Spanish laws that property buyers should be aware of is the law of subrogation, whereby property debts, including mortgages, local taxes and community charges, remain with a Spanish property and are inherited by the buyer. It’s possible, of course, to check whether there are any outstanding debts on a property and this should be done by your legal advisor. However, it’s virtually impossible to prevent a seller fraudulently taking out a loan on a property after you’ve made a check. The procedure has been tightened in recent years, but still isn’t foolproof. Of course, this also applies in other countries.

Holiday Letting: No restrictions. An imputed letting tax is payable by all property owners in Spain, both residents and non-residents, irrespective of whether you let a property. Tax is also payable on letting income at a flat rate of 25 per cent.

Restrictions on Foreign Ownership: None.

Building Standards: Building standards of Spanish property vary enormously from excellent to poor. Care must be taken when buying a Spanish property, whether new or old, and unless you’re absolutely confident that a property is sound you should have a survey carried out. The quality of properties in Spain varies considerably with regard to materials, fixtures and fittings, and workmanship, probably as much or more so than in any other European country.

Personal Effects: European Union (EU) nationals planning to take up permanent or temporary residence in Spain are permitted to import their furniture and personal effects free of duty or taxes, provided they were purchased tax-paid within the EU or have been owned for at least six months. Non-EU nationals must have owned and used all goods for at least six months to qualify for duty-free import. A vehicle owned and used for six months in another EU country can be imported into Spain tax and duty-free. VAT (16 per cent) and duty (10 per cent) are payable on vehicles imported from outside the EU, the rates being based on a vehicle’s value. A registration tax (impuesto municipal sobre circulación de vehículos) of 7 per cent for diesel cars under 2000cc or unleaded cars under 1600cc is also payable. Cars with larger engines pay 12 per cent.

Finance

Currency: Euro (€).

Exchange Controls: None. Funds imported to buy a Spanish property should be officially documented so that on its sale the proceeds can be re-exported.

Interest Rate: Variable. Rates are set by the European Central Bank.

Cost/Standard of Living: In the last decade or so, inflation has brought the price of many goods and services in Spain in line with most other European countries, although many things remain cheaper, including property and rents, food, alcohol, dining out and general entertainment. With the exception of the major cities, where the higher cost of living is generally offset by higher salaries, the overall cost of living in Spain is lower than in many other European countries, particularly in rural and coastal areas.

Income Tax: Income tax is levied on a sliding scale from 18 (on annual income up to €3,606) to 43 per cent (on annual income over €66,111). Non-resident property owners in Spain are liable for income tax at a flat rate of 25 per cent on income arising in Spain, including that from letting a property. All owners of Spanish property (both residents and non-residents) must have a fiscal number (número de identificación de entranjero/NIE).

Capital Gains Tax (CGT): Capital gains tax (impuesto sobre incremento de patrimonio) is payable on the profit from sales of certain assets in Spain, including property. After the first two years there’s an annual deduction (for inflation) of 11.11 per cent for property. CGT isn’t payable when you’re a resident of Spain and sell your principal home, provided the proceeds are used to buy a new home in Spain within two years. The CGT rate is a flat 35 per cent for non-residents and a maximum of 18 per cent for residents. Individuals over 65 are exempt from CGT on Spanish property provided they’ve owned the property for more than three years.

Wealth Tax: Spain has a wealth tax (impuesto extraordinario sobre el patrimonio), known simply as patrimonio. A resident is exempt from paying tax on assets worth up to €108,182 and pays no tax on a primary residence. If a Spanish property is registered in the names of both spouses (or a number of unrelated people), each is entitled to claim the €108,182 exemption. Non-residents must pay tax on the total value of their assets in Spain. The rate ranges from 0.2 per cent on assets of up to €167,130, up to a maximum of 2.5 per cent on assets above €10,696,000.

Inheritance & Gift Tax: Inheritance tax (impuesto sobre sucesiones y donaciones) in Spain is paid by the beneficiaries and not by the deceased’s estate. The amount payable depends upon the relationship between the donor and the recipient, the amount inherited, and the wealth of the recipient, and varies from 0.2 to 34 per cent. There are allowances for close relatives, e.g. direct descendants, direct ascendants and relatives to a third degree.

Value Added Tax (VAT): The standard rate of VAT (called IVA in Spain) is 16 per cent. There are reduced rates of 7 per cent (e.g. drinks other than alcohol and fizzy drinks, fuel, water, communications, drugs and medicines, transport, hotel accommodation restaurant meals; and theatre and cinema tickets) and 4 per cent (e.g. food and books). Certain goods and services are exempt, including health care (e.g. doctors’ and dentists’ services), educational services, insurance and banking.

Background Information

Capital: Madrid.

Population: 40 million.

Foreign Community: Spain has a large expatriate community in its major cities and resort areas including many Americans, British, Germans, Scandinavians and other Europeans.

Area: 510,000km2 (197,000mi2).

Geography: The Spanish mainland measures 805km (500mi) from north to south and 885km (550mi) from east to west, making Spain the second largest country in western Europe after France. The Balearic Islands off the eastern coast comprise the islands of Mallorca (Majorca), Ibiza, Menorca (Minorca) and Formentera, and cover an area of 5,014km2 (1,936mi2), while the Canary Islands, situated 97km (60mi) off the west coast of Africa, cover 7,272km2 (2,808mi2).

Spain also has two North African enclaves, Ceuta and Melilla, administered by the provinces of Cadiz and Malaga respectively. The Pyrenees in the north form a natural barrier between Spain and France, while to the west is Portugal. To the north-west is the Bay of Biscay and the province of Galicia with an Atlantic coast. In the east and south is the Mediterranean. The southern tip of Spain is just 16km (10mi) from Africa across the Strait of Gibraltar, a British territory claimed by Spain and a constant source of friction between Britain and Spain. Spain’s mainland coastline totals 2,119km (1,317mi). The country consists of a vast plain (the meseta) surrounded by mountains and is the highest country in Europe after Switzerland, with an average altitude of 650m (2,132ft) above sea level. The meseta covers an area of over 200,000km2 (77,000mi2) at altitudes of between 600 and 1,000m (2,000 and 3,300ft). Mountains fringe the coast on three sides with the Cantabrian chain in the north (including the Picos de Europa), the Pénibetic chain in the south (including the Sierra Nevada, which has the highest peaks in Spain) and a string of lower mountains throughout the regions of Catalonia and Valencia in the east. The highest peak on the mainland is the Pico de Mulhacén in the Sierra Nevada range (3,482m/11,423ft), which is topped by Mount Teide (3,718m/12,198ft) on the Canary island of Tenerife.

Climate: Spain is the sunniest country in Europe and the climate (on the Costa Blanca) has been described by the World Health Organisation as among the healthiest in the world. Spain’s Mediterranean coast, from the Costa Blanca to the Costa del Sol, enjoys an average of 320 days’ sunshine per year. Continental Spain experiences three climatic zones: Atlantic, Continental and Mediterranean, in addition to which some areas, particularly the Balearic and Canary Islands, have distinct micro-climates. In coastal areas there can be huge differences in the weather between the seafront and mountains a few kilometres inland. In Mallorca rainfall varies from 30 to 40cm (12 to 16in) in the south to over 1.2m (47in) in the north, and Menorca experiences strong winds in winter.

Language: Spanish, or more correctly Castilian (castellano), is the main language, although Basque, Catalan and Galician are also official languages in the respective regions. English is widely spoken in resort areas and the major cities.

Political Stability: Very good. Since the death of General Franco on 20th November 1975, which heralded the end of 36 years of dictatorship, Spain has become a parliamentary democracy, with arguably the most liberal constitution in western Europe (since 1978). Spain has been a member of the European Union since 1986.

General Information

Crime Rate: Spain’s crime rate is among the lowest in Europe and violent crime is rare. Burglary is a problem throughout Spain, particularly for holiday homeowners. It’s necessary to take comprehensive measures to secure your Spanish property and a home safe is recommended for money and valuables.

Medical Facilities: Medical facilities in Spain vary and are generally very good in resort areas and major cities but limited in some rural areas. There are English-speaking Spanish and foreign doctors and dentists in resort areas and major cities. If you aren’t covered by the public health service, private health insurance is essential; it’s recommended in any case if you want the widest possible choice of practitioners and the best treatment without waiting.

Pets: A maximum of two pets may accompany travellers to Spain. A rabies vaccination is usually compulsory, although this doesn’t apply to accompanied pets (including cats and dogs) entering Spain directly from Britain or for animals under three months old. A rabies vaccination is necessary if pets are transported by road from Britain to Spain via France. If a rabies vaccination is given, it must be administered not less than one month or more than 12 months prior to export. Pets over three months old from countries other than Britain must have been vaccinated against rabies. If a pet has no rabies certificate, it can be quarantined.

Residence: A residence permit is a formality for EU nationals, although non-working residents must have sufficient income to maintain themselves in Spain. There’s no fixed income required to obtain a visa to retire to Spain, but proof of income or receipt of a pension is required. An investment of around €90,000 is usually necessary for a non-EU national to start a business in Spain and 30 per cent of this amount must be readily available. Visitors may remain in Spain for up to six months in a calendar year without a residence permit.

Work Permits: Unnecessary for EU nationals, but difficult for other foreigners to obtain.

1. Putting down a Holding Deposit

On finding a property you wish to purchase you will need to negotiate the terms, price and conditions of the sale with the owner. This part of the process is not binding. We would recommend using an independent English speaking legal advisor. Once a purchase price has been agreed, normally a holding or reserve deposit will be required to ensure the property is removed from the market. The sum required will vary between properties and will be based on the purchase price. A time limit for the preagreement to be signed will be arranged and there will also be legal checks to be made.

2. Setting up a Pre-agreement (Contrato privado de compraventa)

The pre-agreement will set out the conditions under which the Buyer and Seller agree to complete the purchase of the property and the price they have agreed upon. Relevant details will generally be included for example the property details, purchase price and the date for completion. A deposit will be required at this point, this will vary, but will generally be 10% of the agreed price. This agreement will include a penal clause if the sale does not go through. If the seller pulls out of the sale your compensation will be double the deposit you have paid, but if you decide not to go through with the sale then your deposit will be lost. Certain checks will need to be made before signing the contract, checks should be made against the title of the property, mortgage status and if the property has any debts held against it. The planning status should also be looked into. These conditions can be varied by the seller and the buyer and other types of agreement can be made.

3. The Contract (Escritura de compraventa)

Before a non-Spanish purchaser can buy a Spanish property they will need to have set up a Spanish bank account and obtained a Spanish tax number (NIE). The completion will take place in the presence of a Notary Public. This is a Spanish public official, by law the deed of sale must be witnessed by a Notary Public. You will also need your own independent, expert legal advisor to act on your behalf. On Completion the buyer must pay the balance, that is the price agreed after the deposit has been deducted, plus any other fees on the completion date. Both buyer and seller must sign the Escritura de compraventa contract, (this is the Spanish equivalent of the title deeds). The title deeds (escritura) will be given to the buyer, this will be done in the presence of a Notary Public, they will certify that the transfer has taken place. The tax office will be sent a copy and the property registry will be informed of the transfer.

IMPORTANT - Disclaimer :

All information provided is believed to be current and provided free of charge. No liability can be accepted for the reliability of the information and statements made as this is obtained from 3rd parties. We always recommend you take legal advice from a fully qualified Lawyer or Notary before buying a property overseas.

Close

Facebook

Facebook Twitter

Twitter Instagram

Instagram